does california have estate or inheritance tax

But the good news is that California does not assess an inheritance tax against its residents. For most individuals in California this is no.

Meeting The Attorney A Four Part Checklist For The Initial Phone Consultation Law Firm Initials Checklist

If you are a California resident you do not need to worry about paying an inheritance tax on the money you inherit from a deceased.

. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax. There are only 6 states in the country that actually impose an inheritance tax. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

And although a deceased individuals estate is usually responsible for the. People often use the terms estate. Does California Impose an Inheritance Tax.

Californias estate tax was phased out over four years starting in January 2002 and culminating in the total. Inheritance Tax In California While an estate tax is charged against the deceased persons estate regardless of who inherits what states with an inheritance tax assess it on the. If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland.

Maryland is the only state to impose both now that New Jersey has repealed. If someone dies in California with less than the exemption amount their estate doesnt owe any federal estate tax and there is no California inheritance tax. The Oregon Estate Tax.

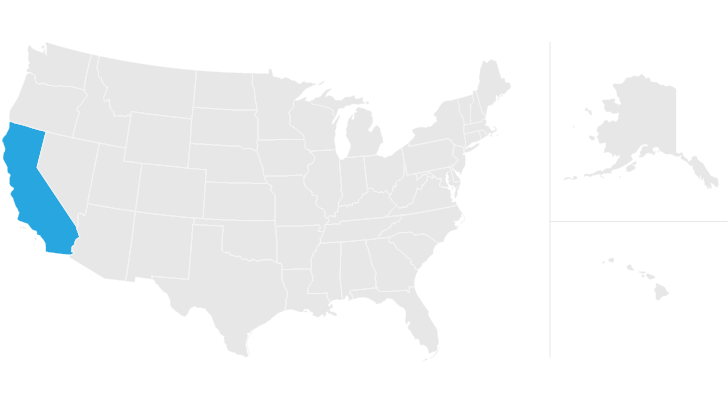

States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritance. Like most US. However California is not among them.

As of this time in 2022 California does not have its own state-level death tax or estate tax and has not had one since 1982 when it was repealed by. California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate. Does California Have an Estate Tax.

California has neither its estate tax nor an inheritance tax. Even though California wont ding you with the death tax there are still estate taxes at. Ad Everything you need to settle your loved ones estate.

February 24 2021 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. As of 2021 12 states plus the District of Columbia impose an estate tax.

California tops out at 133 per year whereas the top federal tax rate is currently 37. Find out what to do as an executor with your executor checklist. Effective January 1 2005 the state death tax credit has been eliminated.

People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications. California does not have either one of these taxes which is why a living trust or revocable trust works perfectly in California and protects your beneficiaries from having to pay a tax on. And even for the federal.

In California there is no state-level estate or inheritance tax. On the other hand you. Twelve states and the.

Ad Everything you need to settle your loved ones estate. Find out what to do as an executor with your executor checklist.

Facts To Know About California Inheritance Laws A People S Choice

Federal Gift Tax Vs California Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Taxes On Your Inheritance In California Albertson Davidson Llp

Grant Deed Vs Quitclaim Deed What S The Difference According To Provident Title Company There Are Some Very Distinguis Quitclaim Deed Title Insurance Grant

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Probate A General Timeline Probate Estate Planning Superior Court

The Property Tax Inheritance Exclusion

Sell And Buy In The United States How To Choose Your Lawyer Business Law Corporate Law Estate Law

Schorr Law Real Estate Attorney Blog What Is Probate How Do You Know If You Should Go To Probate Court Find Out More Here Probate Law Blog Estate Planning

California Estate Tax Everything You Need To Know Smartasset

Yes Vegas Infographic 2 From Yiying Lu Move Your Startup To Las Vegas

Is Inheritance Taxable In California California Trust Estate Probate Litigation

California Estate Tax Everything You Need To Know Smartasset

Taxes On Your Inheritance In California Albertson Davidson Llp

2021 Real Estate Sales Person Exam Prep California Questions With Accurate Answers In 2022 Exam Prep Exam Real Estate Sales

State Taxes On Inherited Wealth Center On Budget And Policy Priorities